The Future of Resource Taxation handbook for Africa’s resource-rich countries launched in Zambia

July 06, 2023

By Wallace Mawire

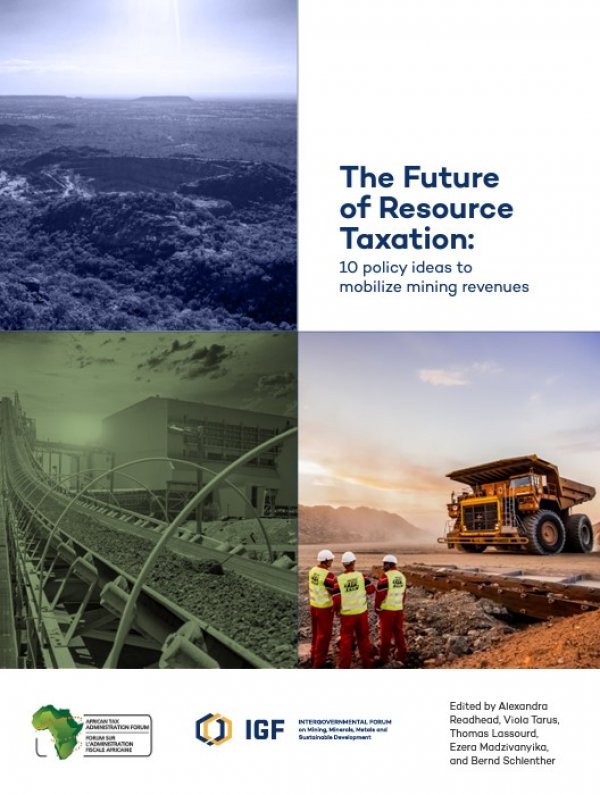

The African Tax Administration Forum (ATAF) has partnered with the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) to rethink how developing countries benefit financially from their mineral resources by launching The Future of Resource Taxation: 10 Policy Ideas to Mobilize Mining Revenues in Zambia, Lusaka.

According to ATAF, both the conference and the handbook extend opportunities for Africa’s resource-rich countries to implement innovative solutions to harness more revenue from the mining sector, said African Tax Administration Forum (ATAF) Deputy Executive Secretary Mary Baine.

Noting the launch of a handbook with 10 innovative policy ideas for governments in resource-rich countries to consider in their bid to harness more revenue from the mining sector, Baine said: “We are convinced that if these ideas are considered and implemented, they will help close some of the loopholes in existing fiscal regimes regarding the governance of natural resources.”

“It was intentional to come to Zambia; one, because Zambia is a resource-rich country and two, to bring solutions to the world to devise some resolutions to the important sector of extractives.”

Baine was speaking at the opening of Global Conference on The Future of Resource Taxation hosted by the Zambia Revenue Authority (ZRA) at the Mulungushi International Conference Centre, Lusaka, Zambia.

Launching the handbook, Dingani Banda, the Commissioner General of the ZRA commended ATAF and IGF for developing the Handbook, describing the document as a good reference for ideas on how mineral-rich economies can enhance revenue generation from the mining industry.

He said the resource extraction industry plays a vital role in global economic development thus the need to address pressing issues surrounding mining taxation. “As we look to the future, it is imperative that we address the pressing issues surrounding mining taxation to ensure a sustainable and equitable future for all,” Banda said.

Noting the timeliness and importance of the publication, Alexandra Readhead, Lead for Tax and Extractives, IGF told delegates that "mining revenue collection is improving”.

“Both Zambia and Mongolia have recently carried out successful transfer pricing audits in the sector resulting in hundreds of millions of US dollars collected. And many mining companies are publicly disclosing where and how much tax they pay,” Readhead said, adding that countries need to reflect on whether their current mining tax system remains fit for purpose.

The conference was officially opened by Hon Situmbeko Musokotwane, Zambia Minister of Finance saying, “Your insights, experiences, and perspectives are invaluable in shaping the future of mining taxation and the creation of a sustainable, equitable, and prosperous global mining industry.” Both the Permanent secretaries in the Ministries of Finance and Trade joined different sessions to respond to questions by participants in moderated fire-side chats, clearly showing the importance the country is placing on the sector.

The minister specifically urged the participants to debate on how best to design policy on how best governments can encourage business in the sector, and facilitate investment while protecting government revenue through equitable taxes.

The conference, held from June 26–28, 2023, was attended by almost 400 people including commissioners-generals and representatives of tax administrations, business, civil society as well as development partners and donors. It reviewed how governments can improve revenue collection from the mining sector.

The Future of Resource Taxation can be found here: https://bit.ly/3r9PVGQ

The African Tax Administration Forum (ATAF) has partnered with the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) to rethink how developing countries benefit financially from their mineral resources by launching The Future of Resource Taxation: 10 Policy Ideas to Mobilize Mining Revenues in Zambia, Lusaka.

According to ATAF, both the conference and the handbook extend opportunities for Africa’s resource-rich countries to implement innovative solutions to harness more revenue from the mining sector, said African Tax Administration Forum (ATAF) Deputy Executive Secretary Mary Baine.

Noting the launch of a handbook with 10 innovative policy ideas for governments in resource-rich countries to consider in their bid to harness more revenue from the mining sector, Baine said: “We are convinced that if these ideas are considered and implemented, they will help close some of the loopholes in existing fiscal regimes regarding the governance of natural resources.”

“It was intentional to come to Zambia; one, because Zambia is a resource-rich country and two, to bring solutions to the world to devise some resolutions to the important sector of extractives.”

Baine was speaking at the opening of Global Conference on The Future of Resource Taxation hosted by the Zambia Revenue Authority (ZRA) at the Mulungushi International Conference Centre, Lusaka, Zambia.

Launching the handbook, Dingani Banda, the Commissioner General of the ZRA commended ATAF and IGF for developing the Handbook, describing the document as a good reference for ideas on how mineral-rich economies can enhance revenue generation from the mining industry.

He said the resource extraction industry plays a vital role in global economic development thus the need to address pressing issues surrounding mining taxation. “As we look to the future, it is imperative that we address the pressing issues surrounding mining taxation to ensure a sustainable and equitable future for all,” Banda said.

Noting the timeliness and importance of the publication, Alexandra Readhead, Lead for Tax and Extractives, IGF told delegates that "mining revenue collection is improving”.

“Both Zambia and Mongolia have recently carried out successful transfer pricing audits in the sector resulting in hundreds of millions of US dollars collected. And many mining companies are publicly disclosing where and how much tax they pay,” Readhead said, adding that countries need to reflect on whether their current mining tax system remains fit for purpose.

The conference was officially opened by Hon Situmbeko Musokotwane, Zambia Minister of Finance saying, “Your insights, experiences, and perspectives are invaluable in shaping the future of mining taxation and the creation of a sustainable, equitable, and prosperous global mining industry.” Both the Permanent secretaries in the Ministries of Finance and Trade joined different sessions to respond to questions by participants in moderated fire-side chats, clearly showing the importance the country is placing on the sector.

The minister specifically urged the participants to debate on how best to design policy on how best governments can encourage business in the sector, and facilitate investment while protecting government revenue through equitable taxes.

The conference, held from June 26–28, 2023, was attended by almost 400 people including commissioners-generals and representatives of tax administrations, business, civil society as well as development partners and donors. It reviewed how governments can improve revenue collection from the mining sector.

The Future of Resource Taxation can be found here: https://bit.ly/3r9PVGQ

The African Tax Administration Forum (ATAF) has partnered with the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) to rethink how developing countries benefit financially from their mineral resources by launching

The African Tax Administration Forum (ATAF) has partnered with the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) to rethink how developing countries benefit financially from their mineral resources by launching